General overview:

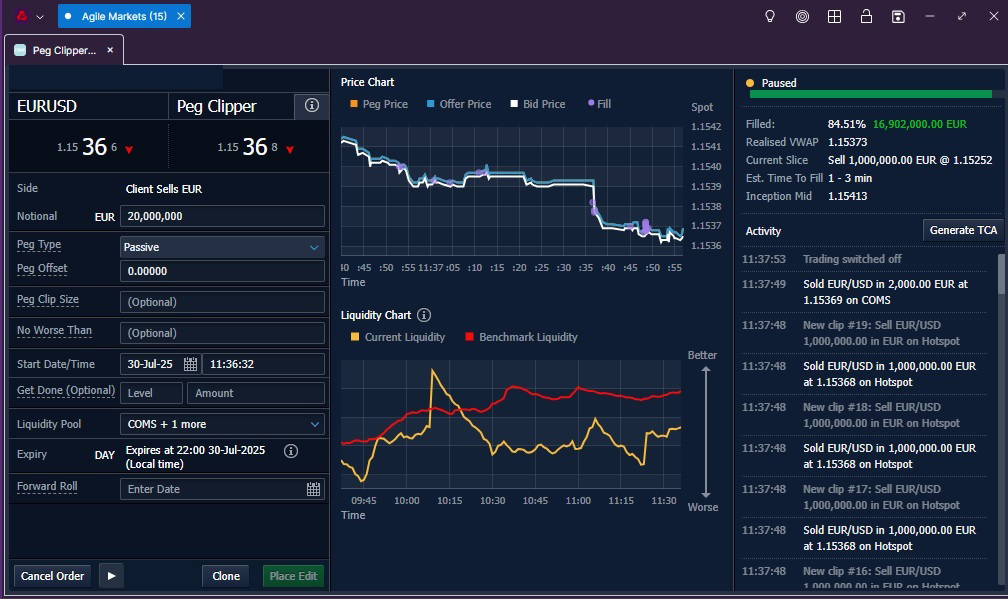

What is the FX algo called?

Peg Clipper, NatWest primary execution algos

What category does it fall into?

Passive/implementation shortfall

What does it attempt to do?

It attempts to fill with the smallest possible market impact, whilst maintaining a reasonable rate of execution. Tradefeedr data tells us that it achieves both of these aims successfully – executing faster and with a lower slippage from inception mid than the average of peers.

Structure:

What is the algo’s software architecture?

100% proprietary software in NY4 colo, alongside our COMS (Client Order Matching System) – a matching engine which leverages the NWM global franchise.

Does it use proprietary modelling?

Yes, extensively. From the adaptive pegging logic to liquidity management, modelling is key to achieving minimal market impact.

Does it use technology such as AI or ML? If so, how?

AI is not used. The algo logic is ‘rules based’ which means it is reliable and repeatable and we will always be able to explain why it did what it did. In determining the rules however, and in curating the COMS liquidity which is key to the algos performance, ML is widely used. I would go as far as to say that this is the single key proprietary ingredient which differentiates this algo from others.

Functional aspects:

Does the algo adapt automatically to prevailing market conditions and if so how?

Yes, Peg Clipper algos are constantly adapting to the market. ‘Adaptive’ dynamics are employed to ensure a smooth rate of fill, minimise adverse selection and optionally target a given end time should the user wish.

Does it incorporate smart order routing?

Yes, again depending on the mode of operation SOR will be used to selectively access liquidity from the wider market if the level of urgency demands it. The algo is particularly flexible, and whilst most users are content to sit quietly in the COMS pool for lowest market impact/best performance, the level of aggression can be scaled up considerably as desired in which case being smart on the wider market access is vitally important.

How does it minimise market footprint?

This is the crux of the matter, and the most important aspect of the algo! The biggest single determinant of any algos performance is the quality of liquidity that it can access, and that means finding those clients or market participants who are truly ‘skew safe’ and will therefore fill the ‘algos’ resting child orders with the least market impact. The primary liquidity pool that almost all Peg Clippers users make use of is COMS – this is our proprietary liquidity pool, and therefore the one that we have the most control over. The secret sauce that we have here is the ability to limit the COMS participants to those in our client base who are truly skew safe, and identify changes to that situation in a very timely manner.

What liquidity seeking and access capabilities does it deploy?

The notion of seeking liquidity over a wide range of venues, and minimising market impact, are not natural bedfellows. In fact I would go so far as to say that they are potentially mutually exclusive! The Peg Clipper in it’s more passive modes (i.e. the ones that yield the best performance) will simply fill quietly in the chosen liquidity pool (usually COMS) and do very little active liquidity seeking as it doesn’t need to. If however the user decides to dial up the speed of execution, the algo will be much more active is utilising a range of venues to find the liquidity that it needs.

What operational risk management does it include?

There are multiple layers of controls, from Fat Finger on inputs through to multiple ‘circuit breakers’ at the container level which will monitor all the algos ‘vital signs’ and either throttle, temporarily pause or in more serious cases halt the algo completely. There are various controls which can also be set at a client or user level, in order to give clients comfort that the usage of the algo can be kept within their own risk appetite.

Parameters and Controls:

What client inputs are available in the algo?

The full list is long, but almost everything can be pre-configured or defaulted – the minimum is simply ‘pair’, ‘direction’, ‘size’. Beyond these 3, optionally almost any aspect of the algo can be controlled real-time by the client. For example, liquidity pools can be changed without pausing the algo, levels of aggression can be very finely tuned, and spot levels which will trigger a change in behaviour can be set.

How much real-time feedback does it provide?

Users of the Agile Markets platform have a rich and interactive experience – a wealth of real time data is visible showing the pegging levels, all individual child fill data and so on. Performance vs various benchmarks are continuously updated. Full TCA reports can be generated at any point during the execution as well as on completion. For clients using a 3rd party GUI, our solution to providing real-time updates is to send a web link by email as soon as the algo is initiated, and this link will enable a view-only version of the Agile Markets algo management screens to be visible.

Capabilities and Use:

What execution styles (e.g. passive/aggressive) does the algo support?

There are 4 pegging styles to choose from: the basic Passive/Mid/Aggressive, which correlate to Slow/Medium/Fast settings, plus an ‘Adaptive’ mode, which used an in-house model to vary the level of pegging real-time to respond intelligently to market moves. A further, secondary offset allows for fine tuning the pegging level to give complete flexibility on the passive to aggressive spectrum.

How can it be integrated/called with/by higher-level workflows?

Although the majority of use cases as a standalone algo the Peg Clipper can easily be integrated into any other automated workflows. The FIX API is available and we have several use cases where clients are calling the Peg Clipper as a ‘Child’ algo of their in-house algo or other execution logic.

What is the optimal scenario for its use?

The optimal scenario is where the user needs to do a large trade in a reasonable timeframe with low market impact. For the Peg Clipper this means using a Passive or Adaptive setting into the COMS pool only, and being willing to allow the algo to fill at the natural pace for the prevailing liquidity.

Any other functionality worthy of note?

The focus on the quality of liquidity is paramount, and it is this that gives the Peg Clipper the level of performance that makes it the go-to algo for many of our most active clients.